Has worker misclassification impacted your life in one way or another? There is little doubt this year will be remembered for seismic changes in our workplaces. Confederate flags, Abercrombie “look policies, ” the “ban the box” movement, transgender rights, and the groundbreaking Supreme Court decision of Obergefell v. Hodges affirming same-sex marriages made headlines as we re-examined and re-defined what constitutes discrimination. Another class of workers, independent contractors, also attracted a great deal of attention. 2015 was a seminal year for the “gig economy.” Consumers engaged “on demand” drivers, shoppers, caregivers, chefs and other “taskers” in record numbers. 2015 saw the rise (and fall) of companies whose smart phone applications made these transactions possible. The proliferation and growth of these companies was fueled in no small part by a business model that treats the workers as 1099s or independent contractors, not as employees. In this post, we’ll recap some of the most important developments affecting independent contractor compliance.

The Department of Labor

According to CorporateCounsel.com, wage and hour suits reached a record high in 2015. The DOL has been very focused on worker misclassification and has increased its efforts to ensure workers are not incorrectly classified as independent contractors. The DOL has stepped up efforts by giving $39 million in grants to states to enhance unemployment insurance programs and to reduce worker misclassification.

On July 15th, 2015, Dr. David Weill of the Wage and Hour Division issued an Administrator’s Interpretation wherein he emphasized that the Fair Labor Standards Act (FLSA) was written to define most workers as employees.

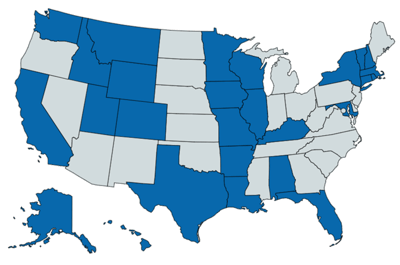

During 2015, the Department of Labor also expanded its Misclassification Initiative and has entered into Memorandums of Understanding with 27 states. The DOL and the respective state agencies will share information obtained in audits and investigations in an effort to better report and curb worker misclassification. The map below shows the states in blue that are part of the misclassification initiative.

Congressional Legislation

In  a continuing effort to keep worker misclassification at the forefront of congressional issues, Senators Bob Casey (D-PA) and Al Franken (D-MN) introduced a bill titled The Payroll Fraud Prevention Act of 2015. The bill defines “non-employee," and requires employers to provide their workers with a written notice of their classification as an employee or non-employee. A similar bill has also been introduced in the House of Representatives.

a continuing effort to keep worker misclassification at the forefront of congressional issues, Senators Bob Casey (D-PA) and Al Franken (D-MN) introduced a bill titled The Payroll Fraud Prevention Act of 2015. The bill defines “non-employee," and requires employers to provide their workers with a written notice of their classification as an employee or non-employee. A similar bill has also been introduced in the House of Representatives.

States Also Crack Down

In addition to entering into information sharing agreements with the Department of Labor and the IRS, many states, including Illinois, Utah, New York, and Louisiana have intensified efforts to identify and crack down on companies that misclassify their workers. Many states have created task forces and introduced legislation aimed at the lack of compliance, especially in certain industries such as construction. Louisiana alone announced in 2015 it identified 9400 misclassified employees.

Litigation on the Rise

Overall, civil litigation as a result of worker misclassification increased in 2015.

- Shepard v. Lowe’s HIW, Inc. settled for $6,500,000 in claims and $1,625,000 in legal fees.

- O’Connor v. Uber, remains in litigation with a trial date scheduled for June, 2016.

- Alexander v. FedEx Ground Package System settled for $228 million dollars.

Major lawsuits that are in litigation in 2016 are filed against Amazon, Lyft, Postmates, Caviar, Homejoy, and Instacart. We expect worker misclassification to be a hot topic again in 2016. Suits were also filed against Amazon, Lyft, Postmates, Caviar, Homejoy, and Instacart

What Does this Means for 2016?

The data on the actual number of workers who are independent or “freelancers” is difficult to obtain, and depends upon many factors. We can, however, provide some clear takeaways on what to anticipate in the coming New Year:

- There is very little likelihood that the employment laws governing worker classification will change from the current binary system of employee or independent contractor.

- Workers will continue to asset their rights to overtime compensation and benefits. Because more companies are using workers through independent contractor (1099) arrangements, litigation for overtime and equal pay will continue to increase.

- Unions will step up their efforts to organize workers in the “gig economy,” as well as workers in industries where union membership has decreased in recent decades.

- 2016 may see the beginning of a trend towards providing independent contractors with tra

ditional protections formerly afforded only to employees, such as rights to unionize, access to health care, and Title VII protections against discrimination based on race, gender or ethnicity. Both employees and independent contractors will continue to bear a greater percentage of their own retirement and health care costs.

ditional protections formerly afforded only to employees, such as rights to unionize, access to health care, and Title VII protections against discrimination based on race, gender or ethnicity. Both employees and independent contractors will continue to bear a greater percentage of their own retirement and health care costs.

More than ever, employers will need to be mindful of how they classify their workers with respect to being exempt for overtime and for tax withholding purposes to avoid costly mistakes of misclassification. Some year-end tips for employers:

- Conduct an internal review of your workers who are classified as exempt for overtime. If you engage independent contractors, ensure your firm has proper documentation of the business arrangement and a written agreement in case of an audit.

- Be sure to issue 1099s to any workers who you are required to report their non-employee income.

- Engage tax and legal advisors if you discover you have workers who may not be correctly classified.

- Review independent contractor contracts with your legal counsel to ensure your confidentiality, arbitration and termination clauses do not conflict with the workers’ status as an independent consultant.

This is one of those areas where an “ounce of prevention” definitely can prevent some serious new year’s headaches. Check out our 10 best practices to classify independent contractors to help you in 2016.

Populus Group

Populus Group Donna Morris

Donna Morris

Leave a comment